Financial Assistant: Directing You Towards Your Monetary Goals

Financial Assistant: Directing You Towards Your Monetary Goals

Blog Article

Discover Reliable Lending Providers for All Your Financial Needs

In browsing the vast landscape of monetary services, discovering dependable financing suppliers that provide to your particular demands can be a challenging job. Allow's explore some essential variables to consider when seeking out finance services that are not only reputable yet also tailored to satisfy your special economic requirements.

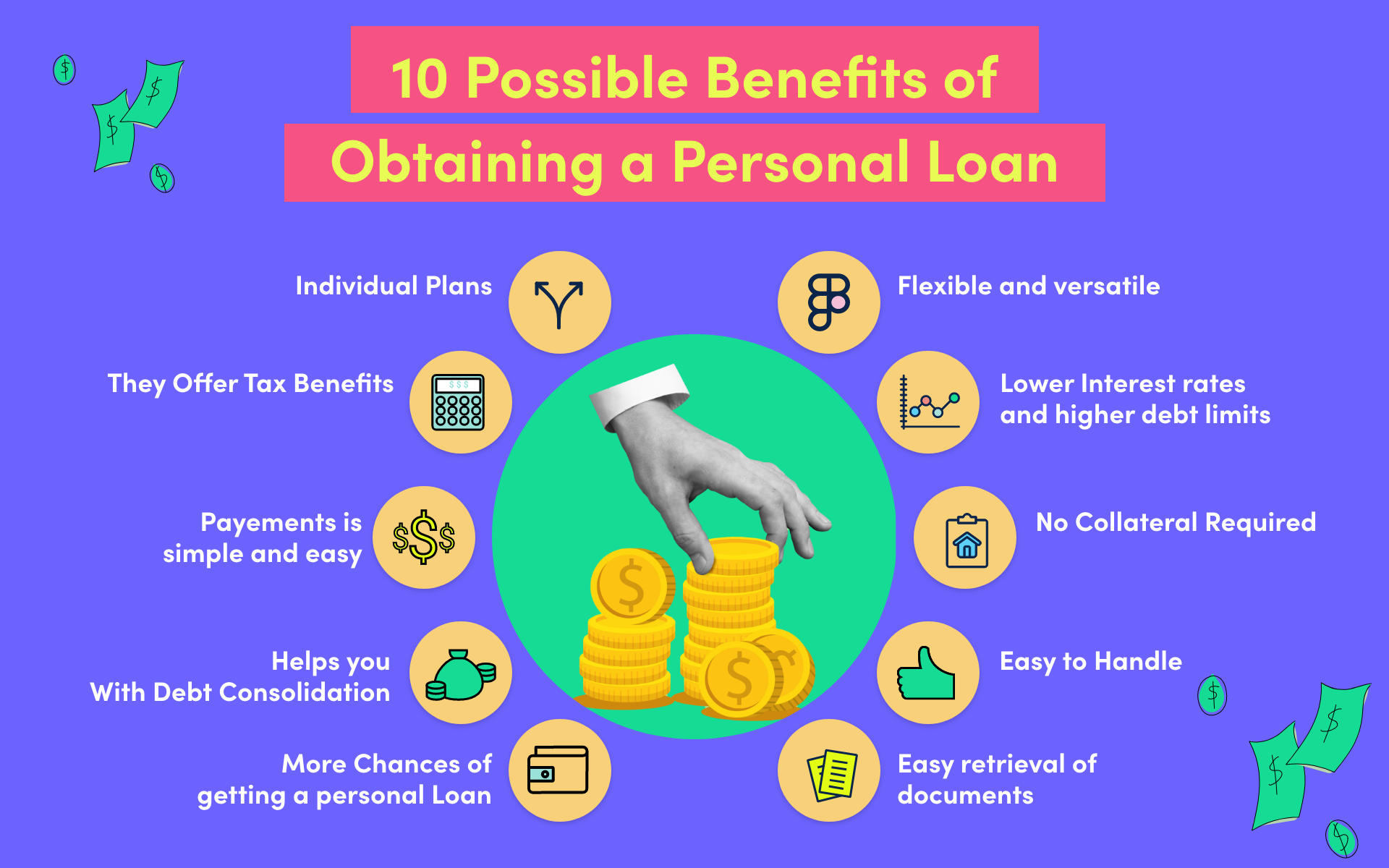

Kinds Of Individual Lendings

When thinking about individual car loans, people can choose from different kinds tailored to satisfy their details financial requirements. For people looking to consolidate high-interest financial obligations, a debt loan consolidation loan is a practical choice. Furthermore, individuals in requirement of funds for home remodellings or major acquisitions might decide for a home improvement financing.

Advantages of Online Lenders

Recognizing Lending Institution Options

Credit scores unions are not-for-profit economic cooperatives that offer a range of products and solutions comparable to those of financial institutions, including cost savings and inspecting accounts, loans, credit score cards, and more. This ownership structure typically converts right into reduced fees, competitive interest rates on fundings and financial savings accounts, and a solid emphasis on consumer solution.

Credit rating unions can be attracting individuals trying to find a much more tailored strategy to financial, as they commonly focus on member complete satisfaction over revenues. Furthermore, cooperative credit union often have a strong area visibility and might use monetary education resources to help members boost their economic proficiency. By comprehending the the original source choices offered at lending institution, individuals can make informed choices concerning where to delegate their financial needs.

Discovering Peer-to-Peer Borrowing

One of the key destinations of peer-to-peer financing is the possibility for lower passion rates compared to typical monetary establishments, making it an appealing choice for debtors. Additionally, the application procedure for getting a peer-to-peer funding is typically streamlined and can result in faster accessibility to funds.

Investors likewise gain from peer-to-peer lending by potentially making greater returns contrasted to traditional investment alternatives. By cutting out the middleman, financiers can straight money borrowers and get a section of the passion payments. Nevertheless, it is essential to keep in mind that like any investment, peer-to-peer loaning lugs inherent risks, such as the possibility of debtors back-pedaling their loans.

Entitlement Program Programs

In the middle of the advancing landscape of economic solutions, a vital element to think about is the realm of Entitlement program Programs. These programs play a crucial function in providing financial assistance and assistance to individuals and companies during times of need. From unemployment insurance to bank loan, entitlement program programs aim to alleviate economic worries and advertise economic stability.

One noticeable instance of an entitlement program program is the Small company Management (SBA) financings. These financings use beneficial terms and low-interest rates to aid small companies grow and browse difficulties - mca loan companies. Additionally, programs like the Supplemental Nutrition Help Program (BREEZE) and Temporary Aid for Needy Families (TANF) provide vital assistance for people and family members encountering financial difficulty

Additionally, entitlement program programs prolong past economic help, incorporating real estate aid, medical care aids, and instructional gives. These efforts intend to attend to systemic inequalities, advertise social well-being, and make sure that all residents have access to fundamental requirements and opportunities for development. By leveraging government support programs, individuals and businesses can weather financial tornados and make every effort in the direction of a much more safe and secure monetary future.

Verdict

Report this page